Daily tender intelligence feed

Track new, closed, and awarded tenders with a daily breakdown of supplier wins, market momentum, and category shifts.

Latest snapshot

Feb 9, 2026

Daily report · 657 new · 126 closed · 8 awarded

Analytics briefings by day and category

Each article is optimized for search and includes charts, winners, and market context.

Public Competition Tender Analysis: Saudi Arabia Dominates New Activity on January 20, 2026

On January 20, 2026, the Public Competition category saw 50 new tenders published, all originating from Saudi Arabia. No tenders were closed or awarded, and the average bid window stands at 19.26 days. This report provides a focused analysis of the day's tender activity within this specific procurement category.

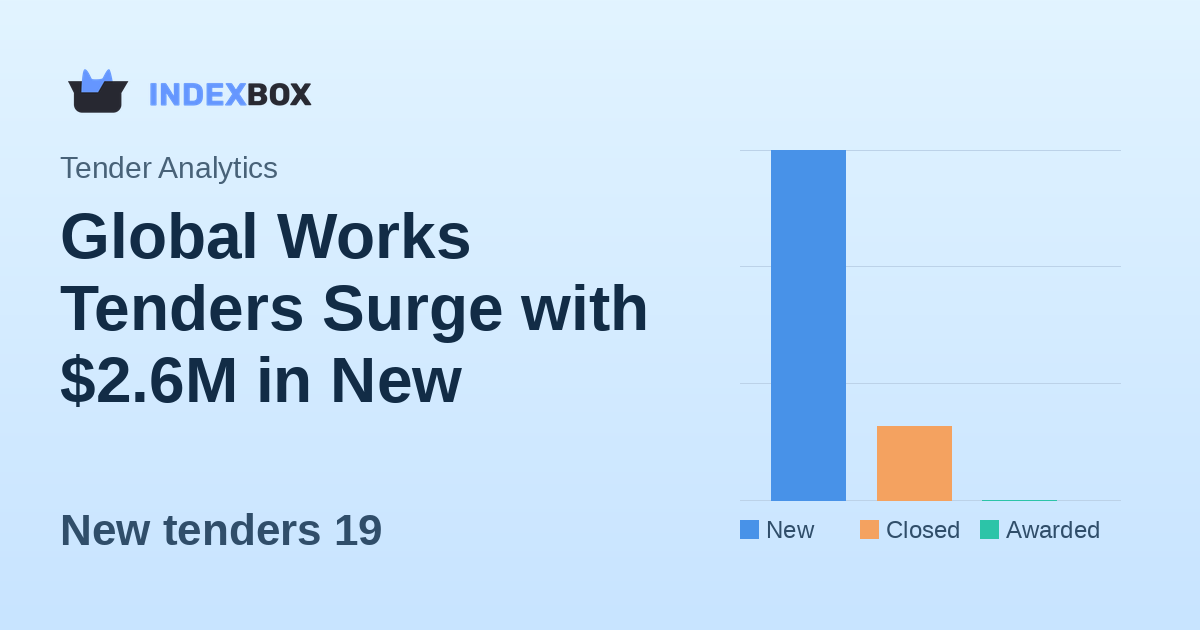

Global Works Tenders Surge with $2.6M in New Opportunities on January 20, 2026

The global Works procurement market showed significant activity on January 20, 2026, with 19 new tenders valued at over $2.6 million USD announced. While no contracts were awarded, the data reveals concentrated activity in the United Kingdom and South Africa, with a relatively short average bid window of just over 16 days for new opportunities.

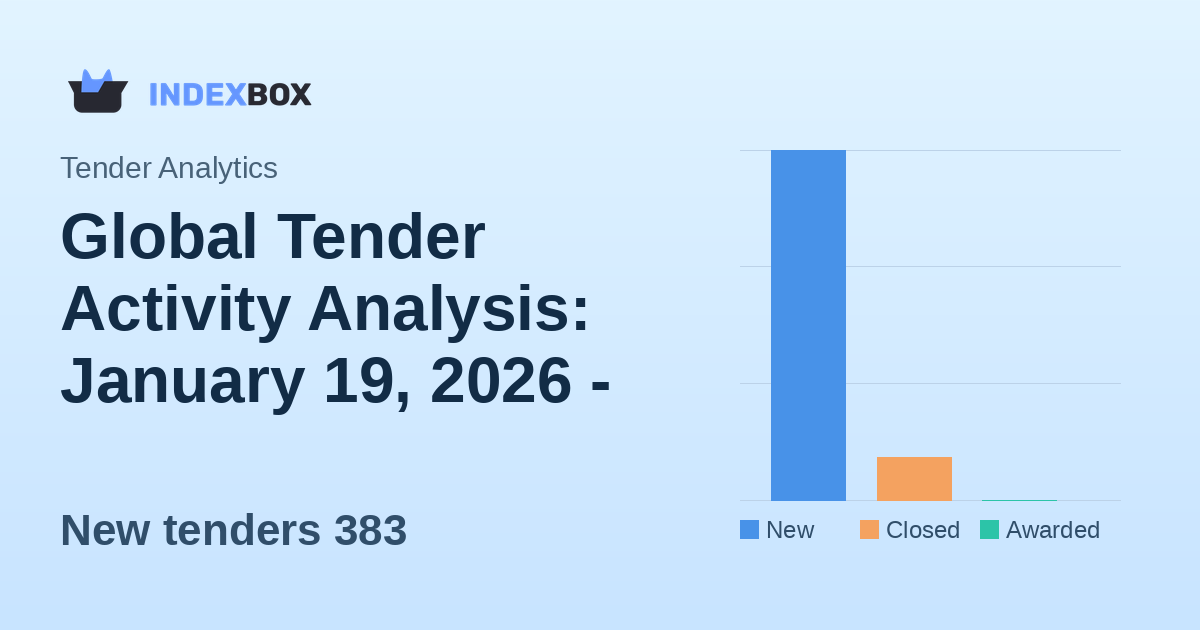

Global Tender Activity Analysis: January 19, 2026 - Saudi Arabia Leads with $1.8 Billion in New Opportunities

On January 19, 2026, global tender activity showed significant new procurement opportunities with 383 new tenders valued at approximately $1.8 billion USD. Saudi Arabia emerged as the most active market, while the average bid submission window remained tight at just over 15 days. The data reveals a concentration in Direct Purchase and Non-Consulting Services sectors, with notable closure activity but no awards reported for the day.

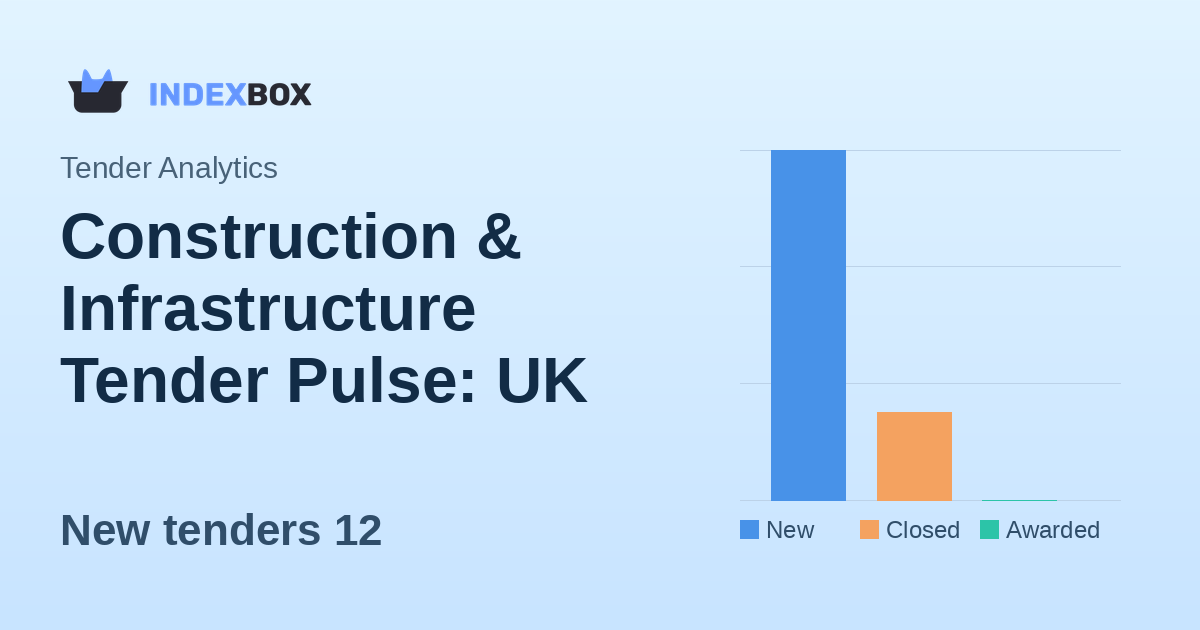

Construction & Infrastructure Tender Pulse: UK Dominates as 12 New Projects Emerge

On January 19, 2026, the Construction & Infrastructure tender landscape showed steady activity with 12 new tenders announced, valued at approximately $2.76 million USD. No contracts were awarded, and the average bid window remained tight at 9 days, indicating a fast-paced procurement environment. All activity was concentrated in the United Kingdom within the core Construction & Infrastructure sector.

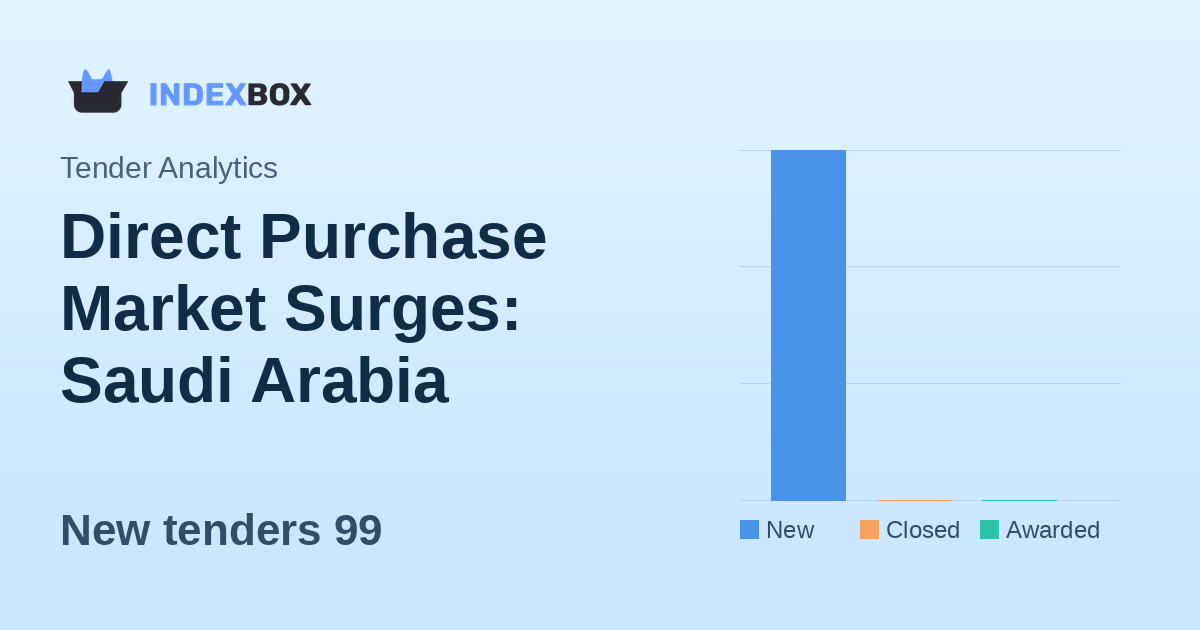

Direct Purchase Market Surges: Saudi Arabia Dominates with 99 New Tenders on January 19, 2026

The Direct Purchase category experienced a significant surge in activity on January 19, 2026, with 99 new tenders announced, all originating from Saudi Arabia. The market showed a rapid average bid window of just under 7 days, though no awards or closures were recorded. This single-day spike represents the entirety of the current trend data, highlighting a concentrated procurement push within this specific category and region.

Procurement Pulse: January 19, 2026 - Significant New Goods Tenders Emerge with $47.7M in Opportunities

The procurement landscape for Goods on January 19, 2026, shows a strong influx of new tendering activity, with 10 new opportunities valued at approximately $47.7 million USD. No tenders were closed or awarded, indicating a fresh batch of opportunities entering the market. South Africa dominates as the primary sourcing country, and the average bid window is just over 12 days, suggesting a fast-paced environment for suppliers.

IT & Software Tender Activity: 12 New Opportunities Emerge on January 19, 2026

The Information Technology & Software tender landscape on January 19, 2026, showed active new procurement with 12 fresh tenders valued at $8.2 million USD, all originating from the United Kingdom. While three tenders closed, no awards were announced, and key metrics like average bid window and winning suppliers remain undefined for the day.

Global Non-Consuiting Services Tenders Surge with $876M in New Opportunities on January 19, 2026

The global Non-Consulting Services procurement market saw significant activity on January 19, 2026, with 68 new tenders valued at approximately $876 million USD announced. The United Kingdom and South Africa emerged as the most active markets, while the average bid window remained at 22.2 days. Notably, no tenders were awarded during this period, indicating ongoing evaluation processes across the sector.

Saudi Arabia Dominates Public Competition Tenders with 50 New Opportunities on January 19, 2026

On January 19, 2026, the Public Competition category saw significant activity with 50 new tenders announced, all originating from Saudi Arabia. The data reveals a streamlined procurement environment with an average bid window of 21.48 days, though no awards or closures were recorded. This analysis examines the day's exclusive focus on Saudi Arabian opportunities and what it means for global suppliers in this specialized procurement category.