Daily tender intelligence feed

Track new, closed, and awarded tenders with a daily breakdown of supplier wins, market momentum, and category shifts.

Latest snapshot

Feb 9, 2026

Daily report · 657 new · 126 closed · 8 awarded

Analytics briefings by day and category

Each article is optimized for search and includes charts, winners, and market context.

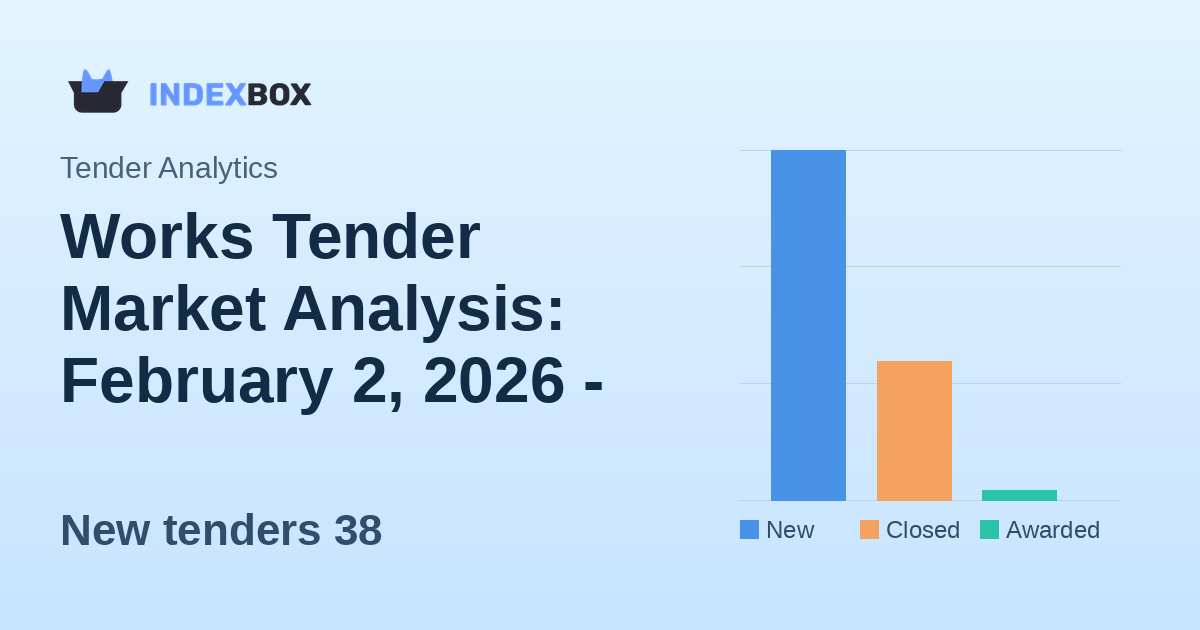

Works Tender Market Analysis: February 2, 2026 - Strong Activity with 38 New Opportunities

The Works category demonstrated robust procurement activity on February 2, 2026, with 38 new tenders valued at $6.1 million USD announced globally. While only one contract was awarded, the market showed significant volume with 15 tenders closing and an average bid window of 18 days. The United Kingdom and South Africa dominated as the most active countries in this sector.

Global Tender Activity Analysis: February 1, 2026

On February 1, 2026, global tender activity saw 73 new tenders published with a total value of $464,351.10 USD, while no tenders were closed or awarded. Saudi Arabia led in tender volume, followed by the United States and South Africa. The 'Other' sector category was most active, and the average bid window stood at approximately 30 days.

Direct Purchase Market Analysis: Saudi Arabia Dominates with 24 New Tenders on February 1, 2026

The Direct Purchase category saw significant activity on February 1, 2026, with 24 new tenders announced, all originating from Saudi Arabia. No tenders were closed or awarded, and no financial values were disclosed. The average bid window stands at approximately 7.2 days, indicating a fast-paced procurement environment. This report provides a detailed analysis of the day's tender metrics, geographical concentration, and sector dynamics.

Public Competition Tender Analysis: February 1, 2026 - Saudi Arabia Dominates New Activity

On February 1, 2026, the Public Competition category saw a focused day of new tender issuance, with all 10 new opportunities originating from Saudi Arabia. No tenders were closed or awarded, and financial values remain undisclosed. The average bid window stands at 23.5 days, indicating a standard response period for this procurement type.

Global Tender Activity Analysis: January 31, 2026 - New Opportunities Emerge with $4.5M in Value

On January 31, 2026, global procurement markets saw 47 new tenders published with a total value of $4.53 million USD, while no tenders were closed or awarded. The United States and South Africa dominated activity, and the 'Other' sector category accounted for the majority of opportunities. The average bid window stands at approximately 27 days, providing suppliers with nearly a month to prepare submissions.

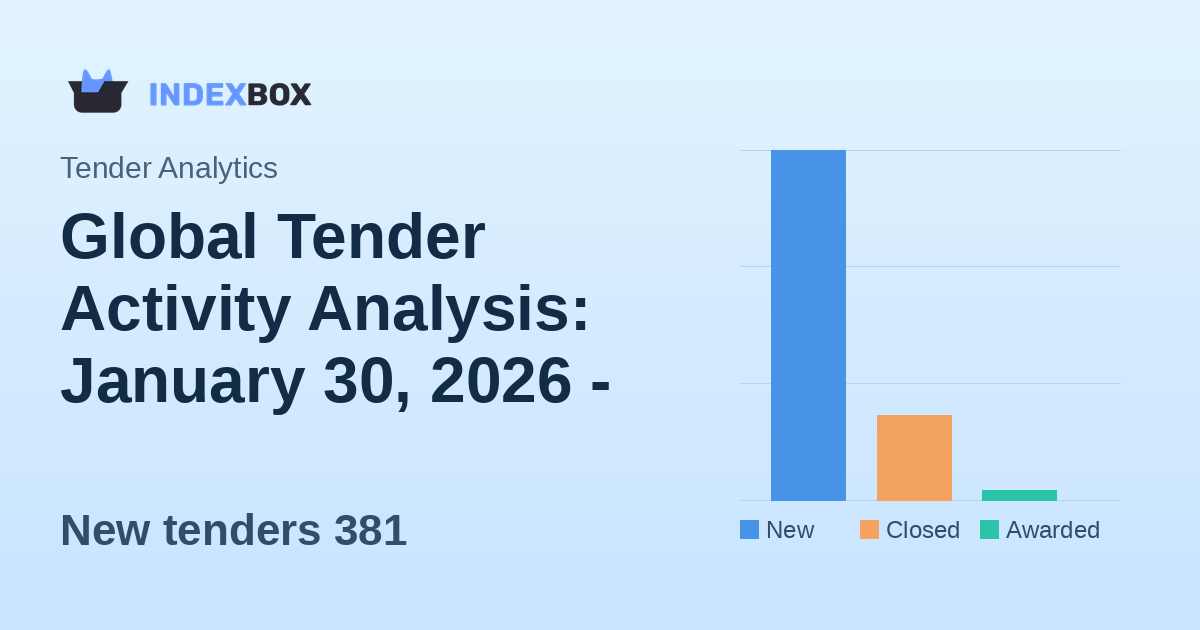

Global Tender Activity Analysis: January 30, 2026 - Strong New Tender Volume with Significant Award Disparities

On January 30, 2026, global procurement markets showed robust new tender issuance with 381 opportunities valued at $579.5 million USD, while award activity remained limited with only 10 contracts awarded totaling $23.4 million. The United States and United Kingdom dominated geographical distribution, while 'Other' sectors represented the majority of activity. The average bid window extended to 167 days, indicating complex procurement requirements.

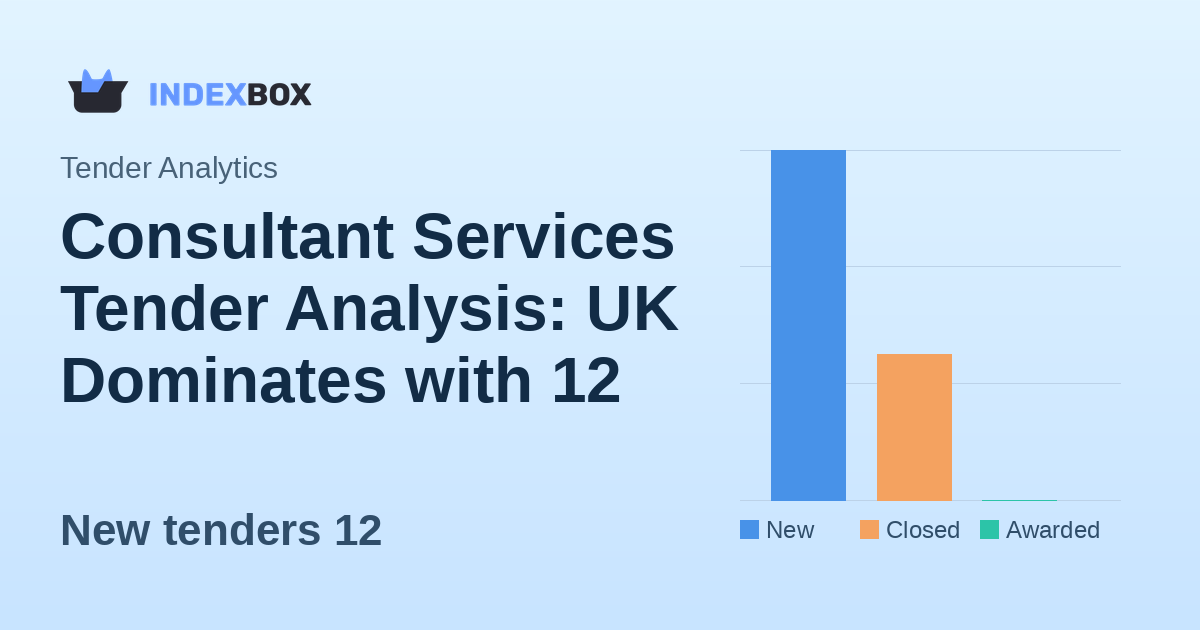

Consultant Services Tender Analysis: UK Dominates with 12 New Opportunities Worth $2.46M on January 30, 2026

The Consultant Services tender market on January 30, 2026, saw significant activity with 12 new tenders published, valued at approximately $2.46 million USD. All opportunities originated from the United Kingdom within the Consultant Services sector, while 5 tenders closed without any awards announced. This analysis examines the day's procurement landscape, highlighting the concentration of activity and the absence of awarded contracts.

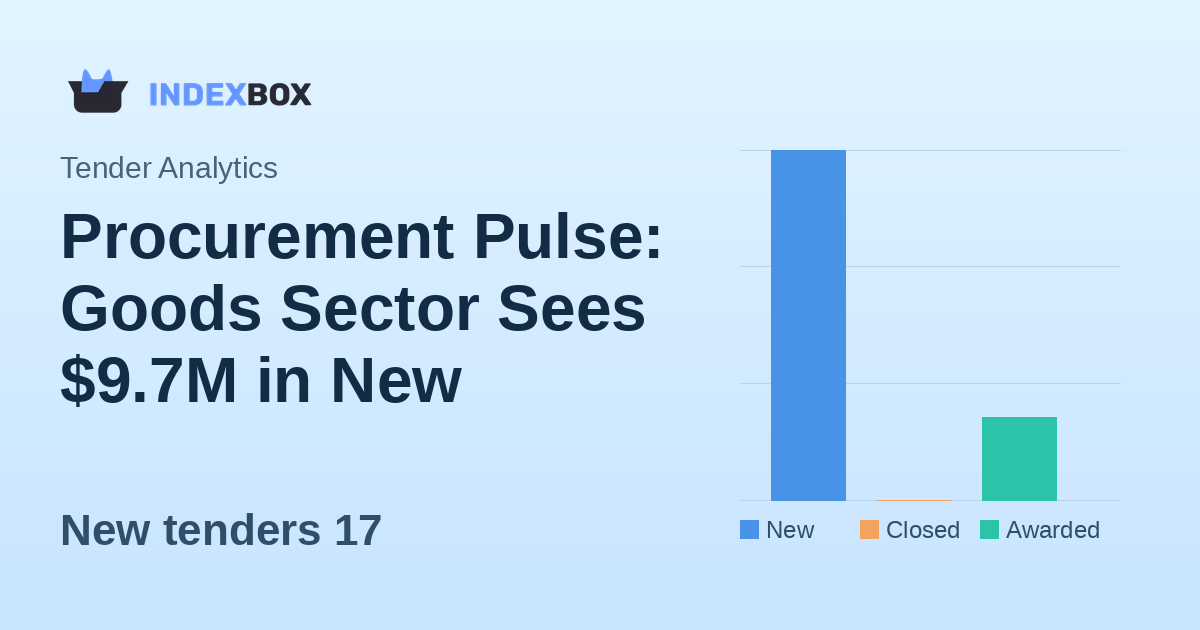

Procurement Pulse: Goods Sector Sees $9.7M in New Tenders on January 30, 2026

The Goods procurement category showed significant activity on January 30, 2026, with 17 new tenders valued at $9.66 million USD. Four contracts were awarded, fully matching the day's new tender value, while bid windows averaged just over 13 days. South Africa and the United States dominated as sourcing countries, with four companies securing awards.

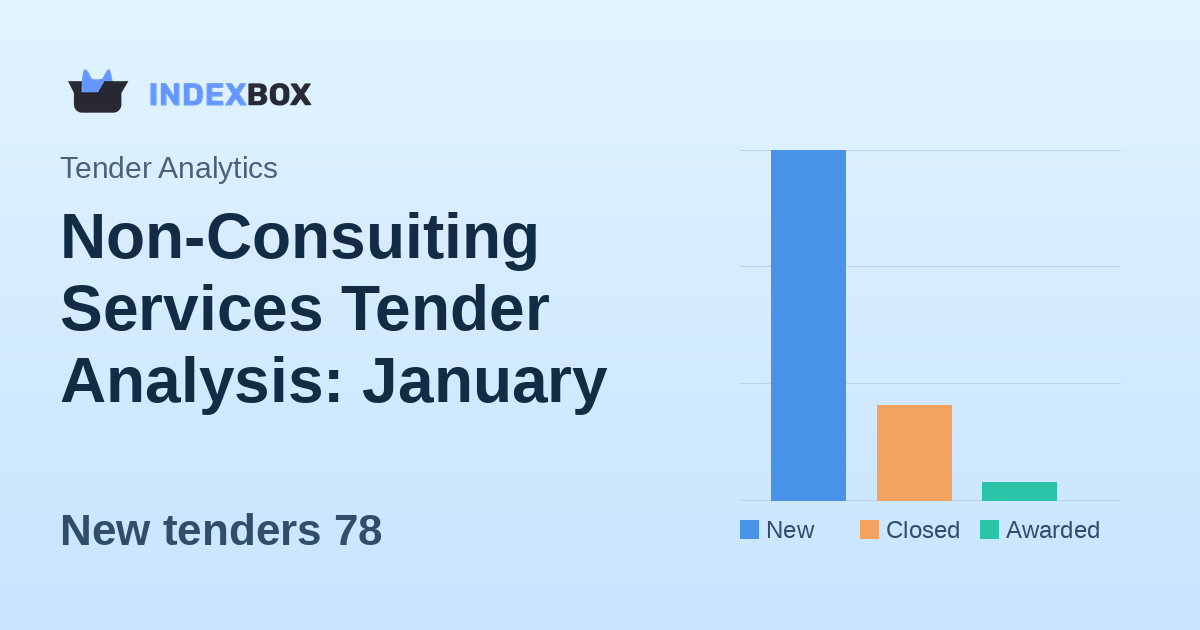

Non-Consuiting Services Tender Analysis: January 30, 2026 - High Volume Day with $352M in New Opportunities

January 30, 2026, marked a significant day for the Non-Consulting Services procurement category, with 78 new tenders published representing $352.3 million in total value. While award activity remained modest with only 4 contracts awarded worth $13.7 million, the substantial new volume indicates strong market demand. South Africa and the United Kingdom dominated the geographical distribution, accounting for 92% of new tender activity. The extended average bid window of 562 days suggests complex, long-term service requirements are being procured.